Estate And Gift Tax Exemption 2025. Below is a summary of the states that as of 2025 still impose estate, gift, or inheritance tax: Irs announces increased gift and estate tax exemption amounts for 2025.

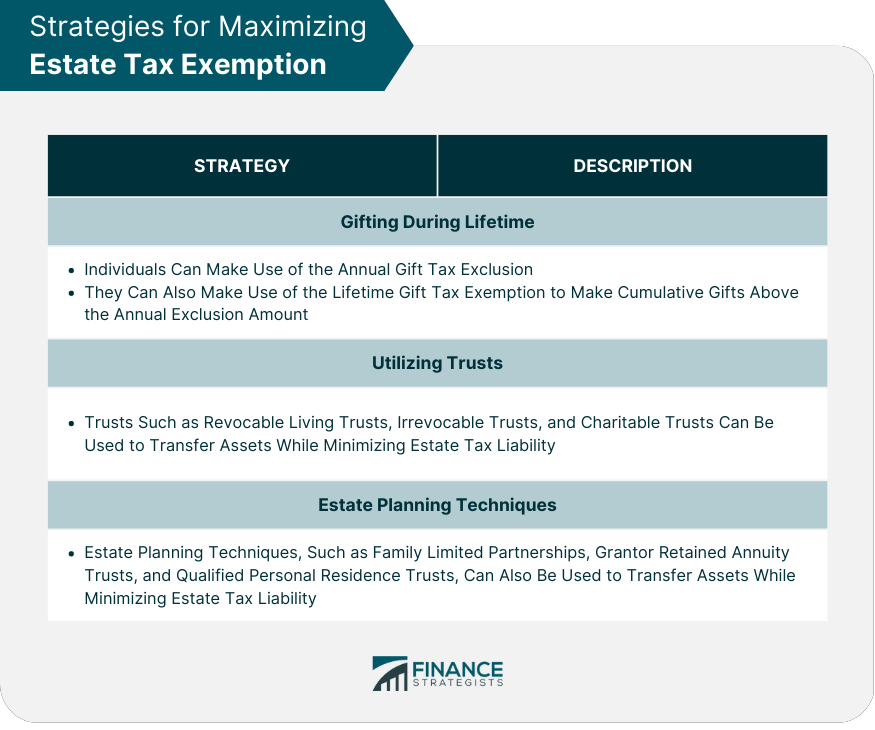

• the federal lifetime gift and estate tax exemption amount (i.e., the total amount you can give away during your life or at death free of gift or estate tax) increases. (2) certain gifts related to a person’s health.

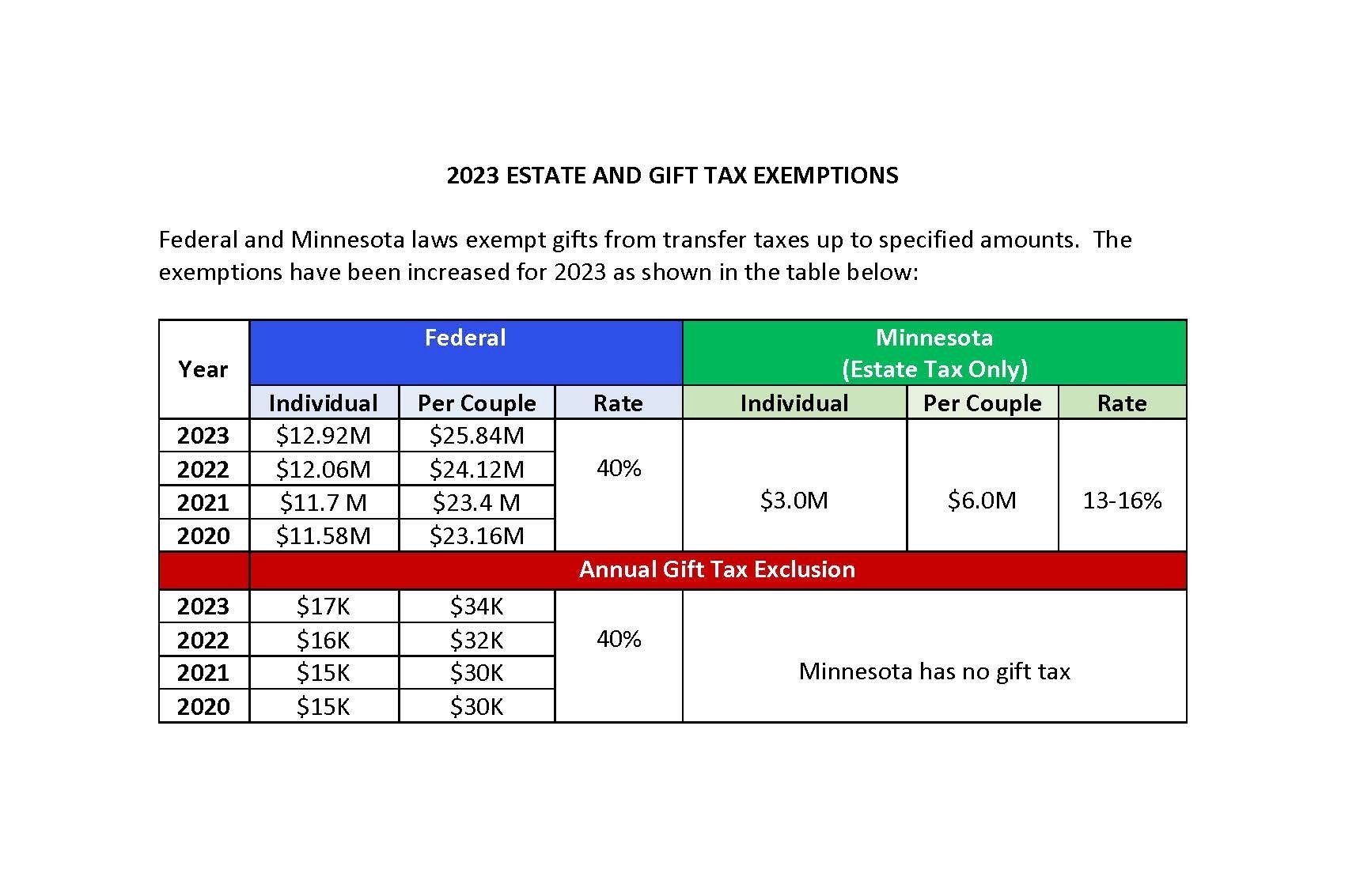

The irs has increased the estate, lifetime gift, and gst tax exemption in response to inflation rates in 2025, offering an opportunity to preserve wealth for.

Understanding 2025 Estate, Gift, and GenerationSkipping Transfer Tax, (2) certain gifts related to a person’s health. Effective january 2025, the federal estate & gift tax exemption is slated to increase by $690,000, reaching $13,610,000 per person (compared to the 2025.

Federal Estate and Gift Tax Exemption set to Rise Substantially for, Lta, usually a component of your salary, covers the expenses of your travel during vacation. The faqs on this page provide details on how tax reform affects estate and gift tax.

2025 Estate and Gift Tax Exemptions Littman Krooks LLP, 2025 brings significant changes to the federal estate and gift tax exemptions. Estate tax exemption increased for 2025.

New 2025 U.S. Estate & Gift Tax Exemptions for 2025 Experienced, How many annual exclusions are available? The federal estate, gift, and gst tax exemptions for u.s.

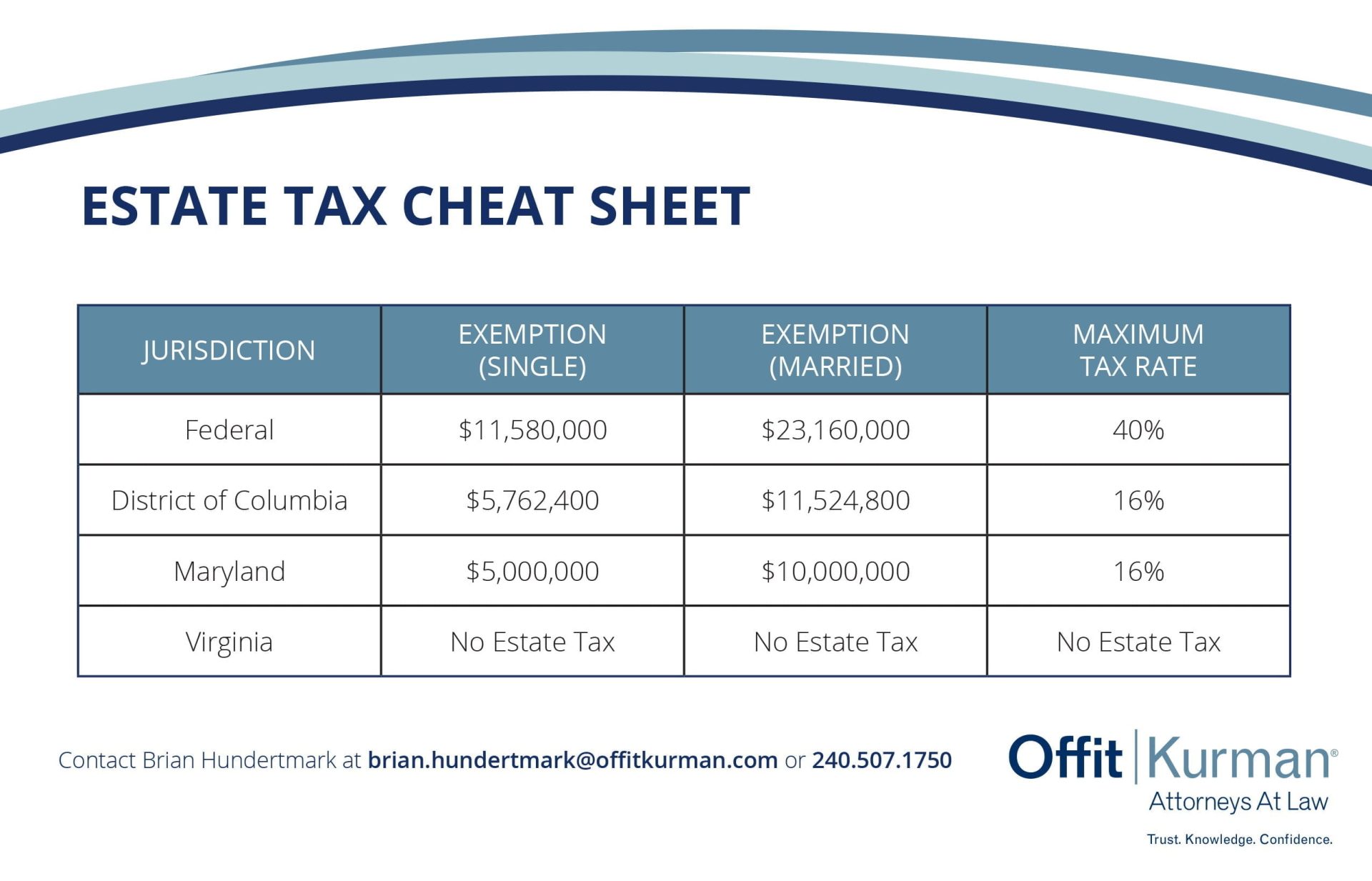

2025 Estate and Gift Taxes Offit Kurman, For 2025, the annual gift tax exclusion. Recently, the irs announced an increased federal estate tax.

Historical Estate Tax Exemption Amounts And Tax Rates, For couples, this exemption will equal. • the federal lifetime gift and estate tax exemption amount (i.e., the total amount you can give away during your life or at death free of gift or estate tax) increases.

.jpg)

2025 Estate and Gift Tax Exemptions — Provenance Law PLLC, Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer, an. The gift and estate tax exemption is $13,610,000 per individual for gifts and deaths occurring in 2025, an increase from $12,920,000 in 2025.

Estate Tax Exemption Definition, Thresholds, and Strategies, The federal estate tax exemption is also set to increase come 2025. Effective january 2025, the federal estate & gift tax exemption is slated to increase by $690,000, reaching $13,610,000 per person (compared to the 2025.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, The unified exclusion amount is $13,610,000 and the annual gift. The internal revenue service has published the 2025 estate and gift exemption amounts.

IRS Raises Estate Tax Exemption Amount for 2025 ShindelRock, The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year. (2) certain gifts related to a person’s health.

As announced by the irs, the key 2025 federal transfer tax exemption amounts per taxpayer are as follows:

The federal government imposes a flat 40% tax on gifts to other individuals, with certain exceptions: